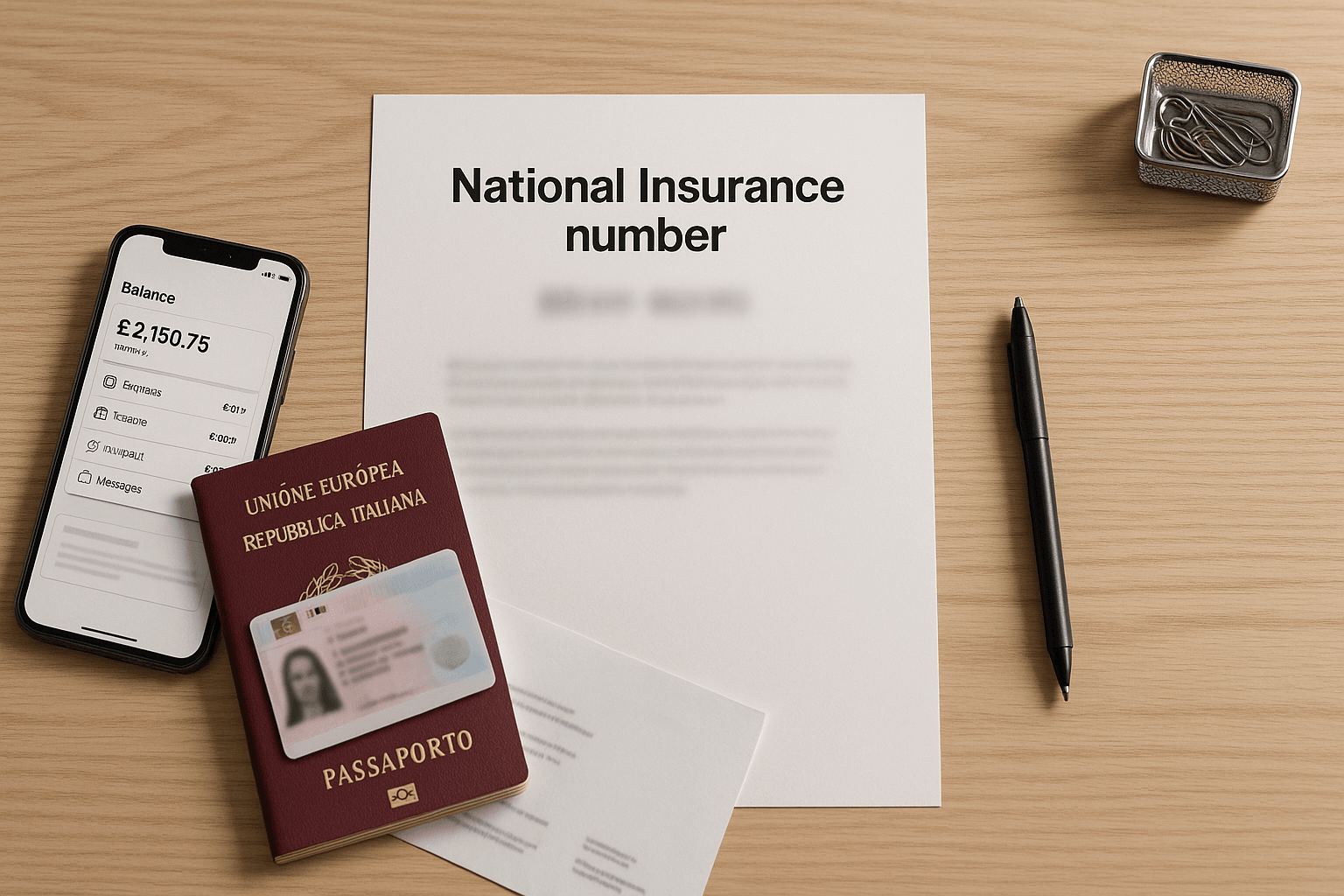

National Insurance Number (NIN) for Italians in the UK (2025): Apply, Replace & Timelines

A National Insurance number (NIN) is your personal reference for tax and social security in the UK. You’ll be asked for it by employers, HMRC, and sometimes for benefits and driving licence processes.

If you want step-by-step help preparing your application or recovering your number, we can assist: View Resinaro Services →

When you need it (and when you don’t)

| Situation | Do you need NIN? |

|---|---|

| Starting a new job | Yes, your employer will request it. |

| Self-employment registration | Yes, strongly recommended. |

| Opening a bank account | Often not required, but some banks may ask. |

| NHS access | Usually not required. |

How to Apply (Online or by Phone)

The process may be updated — always check the official GOV.UK page:

Apply for a National Insurance number (GOV.UK)

- Check eligibility (must be in the UK and have the right to work).

- Complete the online application (or phone if directed).

- Upload/present documents if asked (passport/ID, immigration status, proof of UK address).

- You may receive a letter confirming your application or requesting more info.

- Your NIN letter is posted to your address once assigned.

Documents You May Need

| Document | Notes |

|---|---|

| Passport / ID | Italian passport or carta d’identità. |

| Immigration status | eVisa share code (EU Settlement Scheme) or BRP. |

| UK address proof | Bank statement, tenancy agreement, or utility bill. |

| Employment info | Contract/offer or employer’s details (sometimes requested). |

Timelines & Recovery

| Scenario | Expectation |

|---|---|

| New application | A few weeks to receive your NIN letter (varies). |

| Already working | You can usually start work while waiting; employer uses a temporary marker. |

| NIN letter lost | Find your NIN on payslips, P60, or HMRC app; or request a confirmation letter from HMRC. |

| Name/address change | Update with HMRC to keep records consistent. |

- HMRC – Lost NIN: gov.uk/lost-national-insurance-number

- HMRC app: gov.uk/guidance/sign-in-to-your-personal-tax-account

Common Mistakes (and fixes)

- Applying from outside the UK → generally not possible.

- Wrong address → ensure reliable post delivery; the letter is physical.

- No proof of status → have your share code ready under EU Settlement Scheme.

- Ignoring HMRC letters → respond quickly to requests for more information.

FAQs

Can I work before I get my NIN?

Often yes — your employer can use a temporary reference while your application is processed.

Do students need a NIN?

If you plan to work (even part-time), yes — apply once in the UK.

Does NIN expire?

No, it’s for life.

Want us to check your documents and walk you through the application?

View Resinaro Services →